Gambling Taxes in New Zealand

If you’re a fan of gambling and living in New Zealand, it’s important to understand the gambling taxes so the tax man doesn’t unexpectedly come knocking.

In this guide, we’ll explore everything you need to know about how the books in New Zealand, so you can enjoy your winnings without any nasty surprises.

What are Taxes on Gambling?

Let’s get stuck in by discussing the different types of taxes on gambling in New Zealand.

First up, we have the GST, or Goods and Services Tax. This tax is applied to all forms of gambling, including casinos, sports betting, lotteries, and gaming machines. The rate of GST is currently 15%, so you can expect to see this added to your gambling expenses.

In addition to GST, there are also specific taxes for certain types of gambling. For example, the racing industry is subject to a racing betting levy, and gaming machines are subject to a gaming machine duty as part of fair market value.

These taxes vary in rate depending on the form of gambling and are usually paid by the gambling operator, rather than the gambler themselves.

Types of Gambling Taxes in New Zealand

Now, let’s talk about how different forms of gambling income are taxed in New Zealand. For casino gambling, the tax rate is 20% on gross profits. For lotteries and sports betting, the rate is 10%. Gaming machines, on the other hand, are subject to a combination of GST and a flat-rate duty of $420 per machine per year.

It’s important to note that tax year, these rates are subject to change, so make sure to stay up to date with the latest federal income tax and laws.

What Happens If I Win?

So, you’ve hit the jackpot and won big at the casino – congrats! But what about taxes on your gambling winnings then? In New Zealand, gambling winnings are generally not subject to income tax.

However, if you’re a professional gambler or you’ve won a significant amount of money, you may be subject to tax. If you’re unsure, it’s always best to consult with a tax professional to ensure you’re fully compliant.

Taxation on Different Forms of Gambling

In New Zealand, different forms of gambling, whether it be online gambling or slot machines, are taxed differently based on the specific laws and regulations governing each type of gambling. Here’s an overview of how different forms of gambling are taxed in New Zealand:

Lotto and Instant Kiwi:

Lotto and Instant Kiwi winnings are not taxed in New Zealand. This is because these games are run by the New Zealand government, and the government does not consider winnings from these games to be a form of income.

Casino gambling:

In New Zealand, casino gambling proceeds are subject to a tax rate of 20%. This tax is applied to the total income or net proceeds of the casino, which is the difference between the total amount wagered by players and the total amount paid out in winnings.

Pokie machines:

Pokie machines, also known as electronic gaming machines, are taxed at a rate of 37.12%. This tax is applied to the net proceeds of winnings from the machines, which is the difference between the total amount wagered by players and the total amount paid out in winnings.

Horse and greyhound racing:

Betting on horse and greyhound racing is taxed at a rate of 4% on total stakes. This tax is paid by the bookmakers or TAB, and not by individual bettors.

Sports betting:

Sports betting is taxed at a rate of 2% on total stakes. This tax is a fixed amount also paid by the bookmakers or TAB, and not by individual bettors.

It’s worth noting that while winnings from Lotto and Instant Kiwi are not taxed, other forms of gambling winnings may be subject to income tax if the winnings are considered to be part of a person’s income.

Additionally, casual gamblers may be required to pay tax on any interest earned from their winnings on the horse races (for example) if they choose to invest them.

Deductions and Offsets

One of the most significant deductions available to gamblers in New Zealand in regard to winnings and losses is the ability to claim gambling losses as a deduction against gambling winnings.

This means that if you’ve won money through gambling, but also lost money through gambling losses, you can deduct gambling losses from your winnings when calculating your taxable income.

If you report you’ve made donations to charitable organisations through gambling activities, you may be able to claim those donations as a deduction on your tax return. This deduction can help reduce your taxable income and the amount of tax you owe.

If you’ve won money through gambling activities in another country and paid taxes on those winnings in that country, you may be able to claim a credit for those foreign taxes paid on your New Zealand tax return.

This credit can reduce the amount of tax you owe in New Zealand on those winnings. If you’re ever in doubt about things like itemized deductions or large sums, consider consulting tax attorneys or accountants in your area.

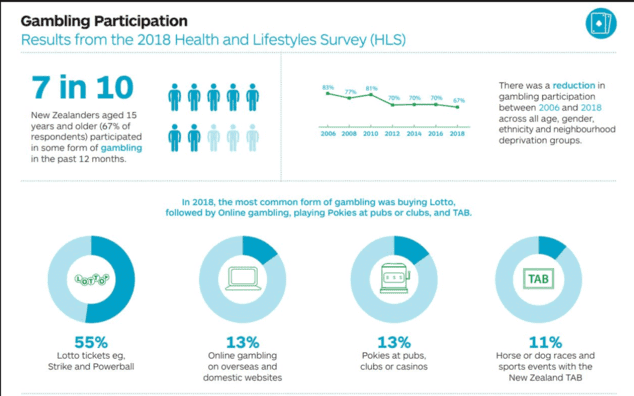

According to the Health Promotion Agency of New Zelanad, gambling activity is dominated by Lotto, with the other activities evenly distributed.

Compliance and Enforcement

Gamblers in New Zealand have compliance requirements they must meet to avoid penalties.

These include keeping accurate records of gambling activities, reporting gambling winnings as income on tax returns, and to pay taxes owed on those winnings (plus any other income).

Failure to comply with these requirements can result in penalties such as fines, interest charges, and even criminal prosecution. In addition, non-compliant gamblers who withhold taxes may be subject to audits on their federal income tax return by Inland Revenue (an internal revenue service), which can be time-consuming and costly.

It’s important for punters to understand their compliance requirements and to take them seriously to make sure they’re above board.

Keeping accurate records of your win amount and reporting all winnings as income on tax returns can help ensure compliance and prevent any legal issues (you don’t want that tax man at your door!)

Noah is the senior content editor at CasinoCrawlers and a writer with many iGaming articles under his portfolio. Therefore, he is skilled at writing bonus guidelines, gambling strategies, and casino reviews. During his spare time, he enjoys playing Call of Duty and is a huge rugby fan.

Read more about the author